In many countries, including India, third-party insurance is a mandatory requirement for vehicle owners, ensuring that victims of road accidents are compensated for damages or injuries. It is an affordable form of insurance that provides legal and financial protection to the insured without covering personal damages. So, what is third-party insurance and what are its benefits?

Third-party insurance is a type of insurance policy that covers the insured against liabilities arising from damage or injury caused to a third party. This form of insurance does not cover the insured party’s own losses or injuries; instead, it provides protection in the event that they are held legally liable for damages or injuries to others. The term “third party” refers to any individual or entity other than the insured and the insurer.

This blog will explain what is third-party insurance, its advantages and disadvantages, how to buy it, and whether it is worth it. Check this blog out for information about the third-party insurance claim process.

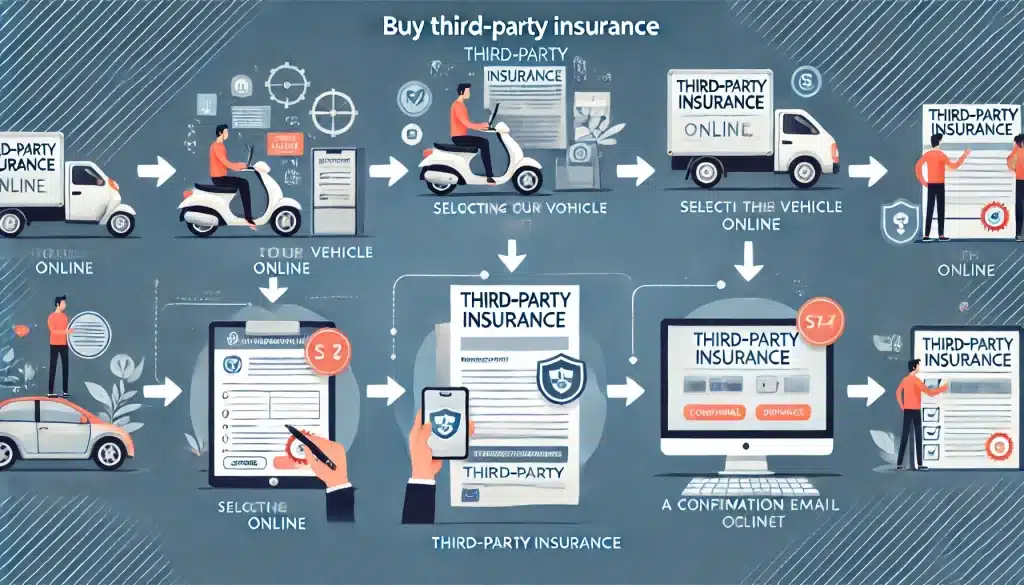

What is the Process to Buy Third-Party Insurance?

Purchasing third-party liability insurance is a relatively simple and straightforward process. Here is a step-by-step guide to help you through the process:

- Research Insurance Providers: The first step is to identify a reliable insurance provider. Check different companies that offer third-party insurance and compare their terms, services, and premium amounts.

- Choose the Type of Vehicle: Depending on whether you need insurance for a two-wheeler, car, or commercial vehicle, you’ll need to select the appropriate policy. Ensure that the policy you are choosing caters to your specific vehicle type.

- Fill Out the Application Form: Once you’ve chosen an insurer, you’ll need to fill out an application form either online or offline. The form will ask for details such as your vehicle registration number, chassis number, engine number, and personal information.

- Submit Required Documents: Typically, you will need to provide documentation such as your vehicle’s registration certificate, proof of identity (Aadhaar card, voter ID), proof of address, and a passport-sized photograph.

- Get a Quote: After filling out the form and submitting the documents, the insurance company will provide you with a quote based on your vehicle type and coverage needs.

- Make the Payment: Once you receive the quote and are satisfied with the policy terms, the next step is to make the payment. Most insurance companies offer multiple payment options, including credit card, debit card, net banking, and UPI.

- Receive Your Policy Document: After the payment is made, the insurance company will issue your policy document. You can receive this document via email (if purchased online) or as a hard copy. Keep this document safe, as it serves as proof of insurance coverage.

Also read: Check out the Mahindra Thar Roxx SUV!

Why Do You Need Third-Party Insurance?

There are several reasons why third-party insurance is essential, especially for vehicle owners. Here are the key reasons why you need third-party insurance:

- Legal Requirement: In many countries, including India, third-party insurance is a legal obligation for vehicle owners. Driving without third-party car insurance can result in hefty fines, penalties, or even legal consequences.

- Financial Protection: Accidents can lead to substantial financial liabilities, especially if third-party property or individuals are involved. Third-party insurance covers these liabilities, sparing you from bearing the full financial burden.

- Peace of Mind: With third-party auto insurance, you are assured that in the event of an accident, the insurance company will take care of compensating the injured third party or paying for damages caused to their property.

- Affordability: Compared to comprehensive insurance policies, third-party insurance is more affordable and provides essential coverage at a lower premium, especially for those on budget.

- Protection Against Legal Costs: Legal proceedings following an accident can be costly and time-consuming. Third-party insurance covers legal expenses, ensuring that you are not paying out of pocket for legal fees.

What Does Third-Party Insurance Cover?

Third-party insurance typically covers the following:

- Bodily Injury to a Third Party: If an accident caused by the insured results in bodily injury or death to a third party, the insurance policy will compensate the injured party or their family. This includes covering medical expenses, hospitalization, and compensation for loss of income in case of permanent disability.

- Property Damage to a Third Party: If the insured causes damage to third-party property, such as a vehicle, house, or business, third-party insurance will cover the cost of repairs or replacement. For example, if you accidentally crash into someone’s car or fence, the insurance will pay for the damages.

- Death Compensation: In the unfortunate event of a fatal accident, third-party insurance provides financial compensation to the deceased’s family. This compensation is determined by the court based on the extent of the damage caused.

- Legal Liabilities: If a third party decides to take legal action against the insured, third-party insurance will cover the legal costs associated with the lawsuit, including lawyer fees and settlement amounts if required.

Advantages and Disadvantages of Third-Party Insurance

Now that we’ve looked at what is third-party insurance, let’s explore its advantages and disadvantages.

Advantages:

- Affordable Premiums: One of the most significant advantages of third-party insurance is its affordability. Compared to comprehensive insurance policies, the premium for third-party insurance is significantly lower, making it an ideal choice for budget-conscious individuals.

- Legal Compliance: Third-party insurance helps vehicle owners comply with the legal requirement of having insurance, avoiding penalties, fines, and possible legal action.

- Coverage for Third-Party Liabilities: Third-party insurance provides financial protection in case of accidents involving third parties, covering bodily injuries, death, and property damage.

- Peace of Mind: Knowing that you are protected against third-party claims offers peace of mind. You won’t have to worry about bearing the financial consequences of an accident or facing legal action.

Disadvantages:

- No Coverage for Own Damages: Third-party insurance does not provide coverage for damages to your own vehicle or injuries sustained by you in an accident. You will need to bear the cost of repairs or medical expenses out of pocket.

- Limited Coverage: Third-party insurance only covers specific types of accidents and liabilities. It does not offer coverage for theft, natural disasters, or vandalism.

- No Add-On Covers: Unlike comprehensive insurance, which allows you to add additional covers such as roadside assistance or zero depreciation, third-party insurance does not offer the option to customize coverage.

What is Third-Party Insurance Beneficial For?

Third-party insurance comes with several benefits that make it an attractive option for vehicle owners:

- Financial Security: Third-party insurance provides financial security in the event of an accident, ensuring that you don’t have to bear the financial burden of compensating third parties for injuries or property damage.

- Legal Compliance: As mentioned earlier, third-party insurance is mandatory in many regions. By having third-party insurance, you are complying with the law and avoiding penalties and fines.

- Simple and Quick Process: Buying third-party insurance is a straightforward process that can be completed online or offline. It requires minimal documentation and provides instant coverage.

- Protection Against Major Liabilities: Accidents can lead to significant financial liabilities, especially when third parties are involved. Third-party insurance protects you from these liabilities, allowing you to focus on recovery rather than financial stress.

- Legal Support: In case of a lawsuit following an accident, third-party insurance covers legal fees and court costs, ensuring that you are not financially burdened by legal proceedings.

Is Third-Party Insurance Worth It?

The value of third-party insurance depends on your specific needs and circumstances. For many vehicle owners, third-party insurance is worth it because:

- Mandatory Coverage: As a legal requirement, third-party insurance is non-negotiable for vehicle owners in many countries. Therefore, having it is necessary to avoid legal consequences.

- Cost-effective: If you are looking for basic insurance coverage at an affordable price, third-party insurance is an excellent option. It provides essential protection without the higher premiums associated with comprehensive policies.

- Best for Low-Risk Drivers: If you drive frequently or live in an area with low accident rates, third-party insurance may be sufficient. It offers the minimum required coverage without the additional cost of comprehensive insurance.

However, third-party insurance may not be ideal for everyone. If you own an expensive vehicle or live in an area prone to theft or accidents, you may want to consider comprehensive insurance for broader coverage.

Top Reasons to Buy a Third-Party Insurance Policy

Here are the top reasons why you should consider buying a third-party insurance policy:

- Legal Requirement: In many countries, including India, third-party insurance is mandatory by law. Buying a third-party insurance policy ensures that you comply with legal regulations and avoid penalties.

- Affordable Coverage: Third-party insurance is an affordable option for those who want basic coverage without paying high premiums. It offers financial protection against third-party liabilities at a reasonable cost.

- Protection from Legal Liabilities: In case of an accident where you are at fault, third-party insurance protects you from bearing the financial responsibility for third-party damages or injuries. It also covers legal expenses if the case goes to court.

- Quick and Easy Purchase: Buying third-party insurance is a hassle-free process that can be completed online or offline with minimal documentation. The process is straightforward, making it accessible to most vehicle owners.

- Essential for Commercial Vehicles: For businesses that operate commercial vehicles, third-party insurance is a critical form of protection. It ensures that any accidents caused by your commercial vehicles are covered, preventing financial loss.

Conclusion: what is third-party insurance?

In conclusion, third-party insurance is an essential form of coverage that provides legal and financial protection to vehicle owners. While it may not cover your own vehicle’s damages, it ensures that you are protected from third-party liabilities, making it a cost-effective and necessary insurance option. We hope we’ve been able to explain ‘what is third-party insurance?’ in a clear and concise manner.

Stay updated on auto loans, bike insurance, and the financial aspects of car and bike ownership with blogs on AUTOLIVENEWS. Keep reading for the latest car news and bike news in India and for the answer to pressing questions like ‘how to renew expired insurance’, ‘the difference between third-party and comprehensive insurance’, and more!

Frequently Asked Questions (FAQs)

What are the benefits of third-party insurance?

If you get into an accident and are at fault, third-party car insurance prevents you from paying legal liabilities, hefty settlements and medical fees out of pocket.

Is third-party insurance really mandatory in India?

Yes, it is illegal to drive a vehicle in India without having valid third-party motor insurance.

What is the difference between third-party and first-party insurance?

In the event that you are the insured person and get into an accident, third-party insurance will pay for the damage you cause to other people, whereas first-party insurance will compensate you for damages you have suffered.

Is comprehensive insurance better than third-party insurance?

While third-party insurance is cheaper and mandatory, comprehensive insurance provides a wider coverage but is usually more expensive.

Can third-party insurance be transferred with car ownership?

Yes, if you are selling your car, you can transfer the car insurance to the new owner as well.